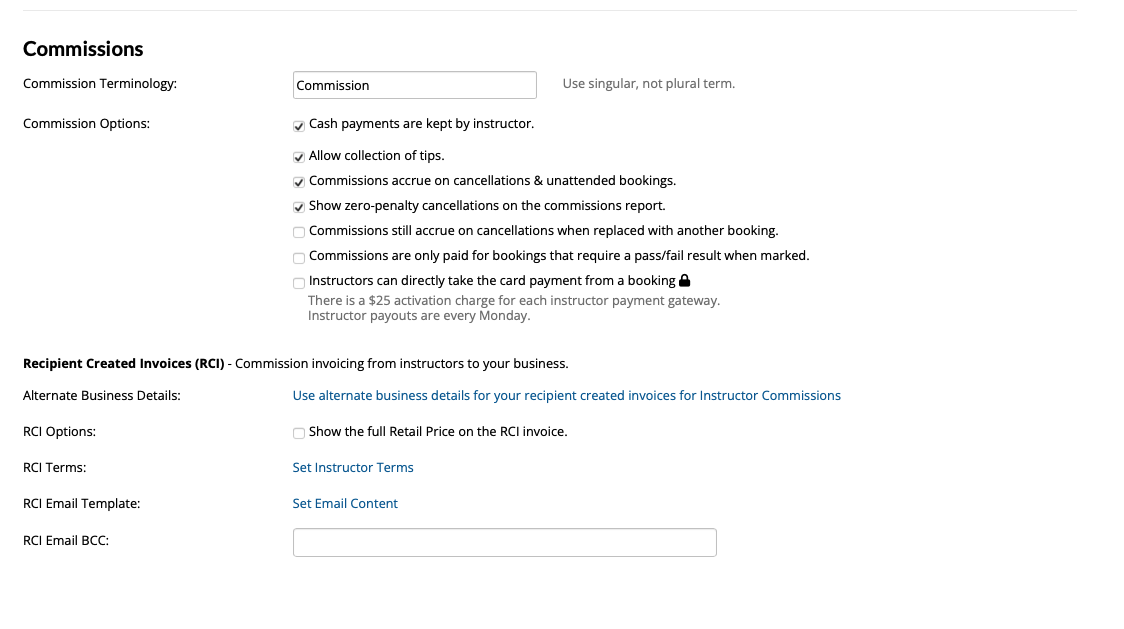

There are some business finance details that need to be set up for your business such as your business identifier (e.g. ABN), tax settings (e.g. GST, VAT, sales tax), commission options, invoicing details and booking payment preferences.

Business finance details

Steps

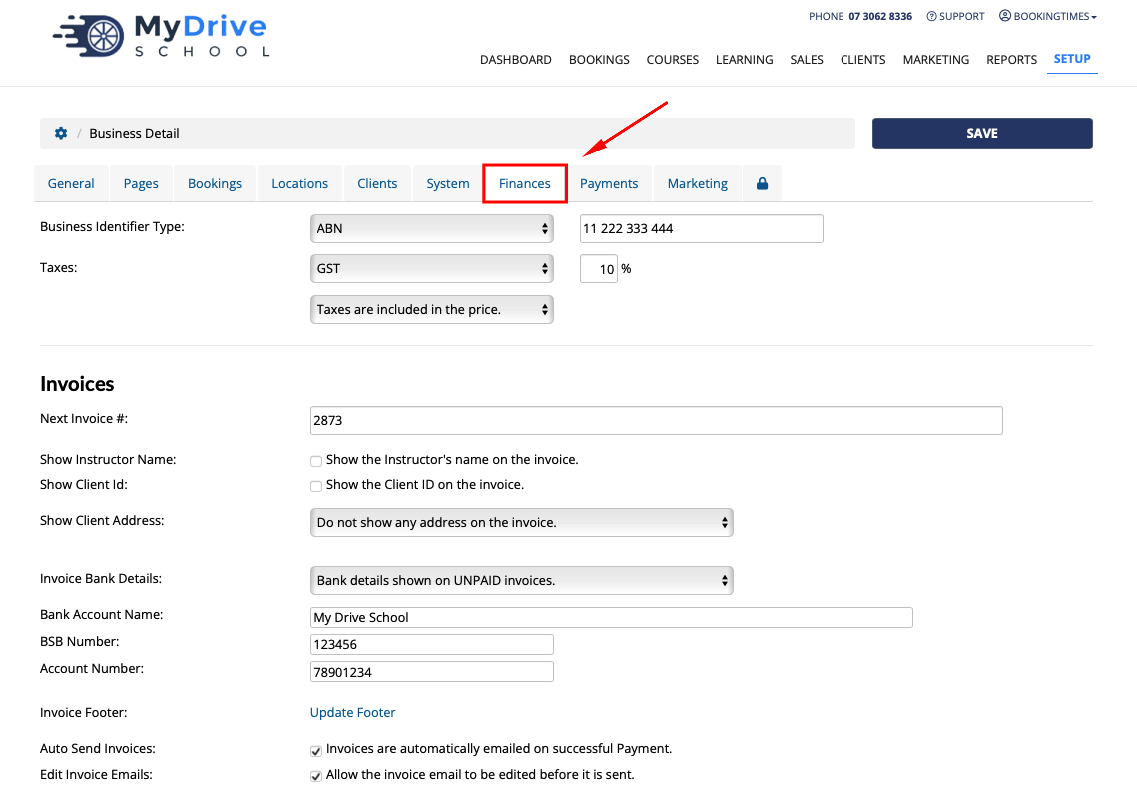

Navigate to Setup > System Settings > Business Detail

Navigate to the Finances tab

Complete the relevant fields

Please see the Creating an invoice article for more information regarding Invoices

Upfront booking payments

Forcing upfront booking payments

You are able to determine if the client needs to provide full payment prior to any bookings. It is highly recommended to turn this option on, as it reduces the possibility of no-shows and also helps enforce your cancellation policy.

If you choose to not force upfront payments, you will instead need to follow up clients for payments, which you can do by sending them the invoice, and the client can then make the payment online or in person.

Steps

Navigate to Setup > System Settings > Business Detail

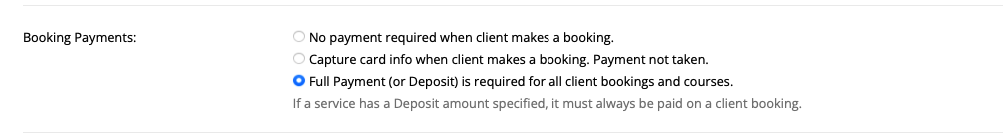

Navigate to the Bookings tab

Scroll down to the Booking Payments section

Note: It's recommended to select the Full Payment (or deposit) is required for all client bookings and courses option. If you don’t you will need to follow up clients for payments