Your business may be required to pay sales tax or goods and services tax (e.g. GST). You can add sales tax to your prices by following the steps below. Sales tax can be added to all products and services on the website or to individual products and services only. This will then be displayed on any invoices accordingly.

Set sales tax rate

Steps

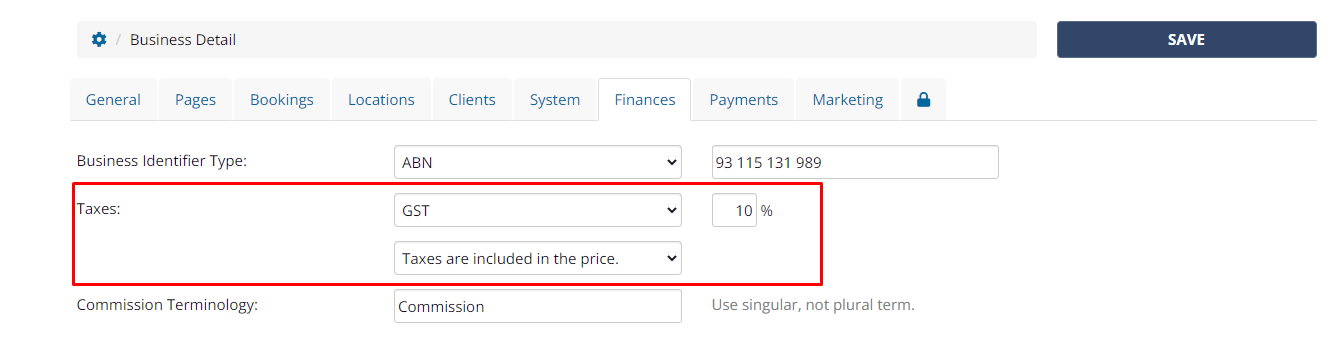

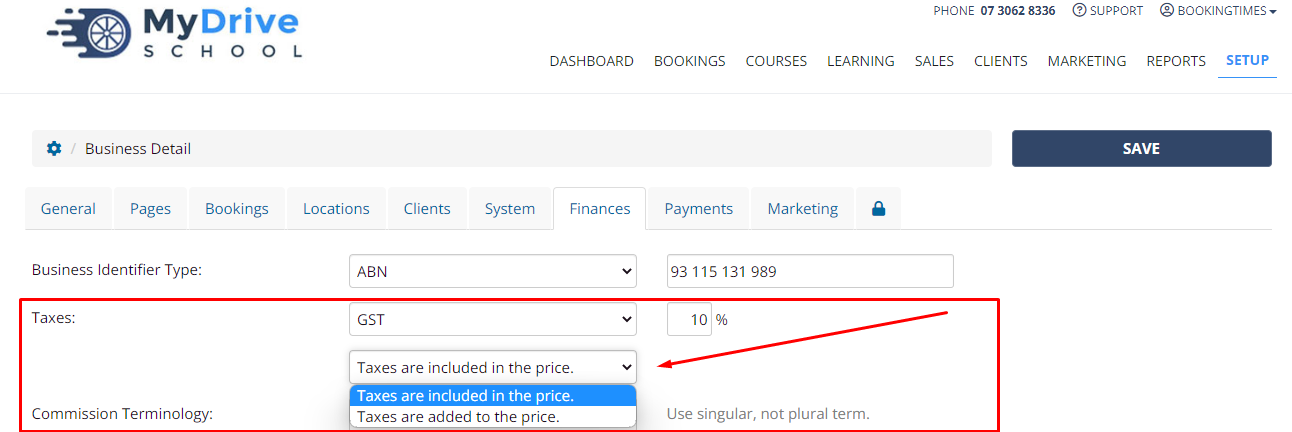

Go to Setup > Business Detail > Finances

Under Taxes select your tax terminology and then set the percentage rate

Set whether the taxes are already included in the price for your products and services or if you'd like the system to add the tax on top of the price of your products and services.

Click Save

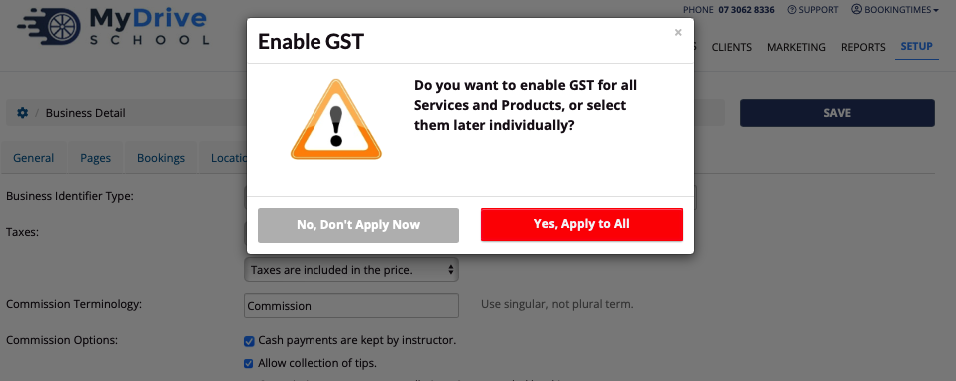

The system will prompt you if you would like all services and products to have sales tax applied. If not, please see the next section on how to add them to each service and product individually.

Set sales tax to services

Steps

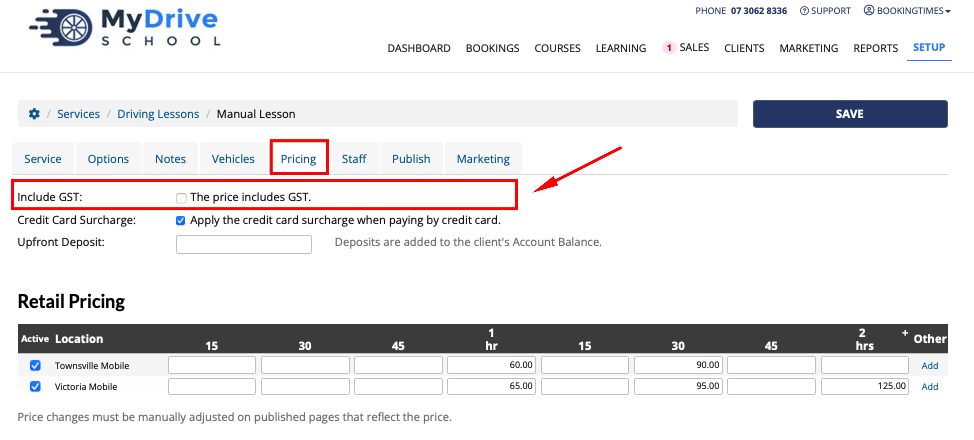

Navigate to Setup > Bookings > Services

Select the service

Check Include GST field

Click Save

Set sales tax to products

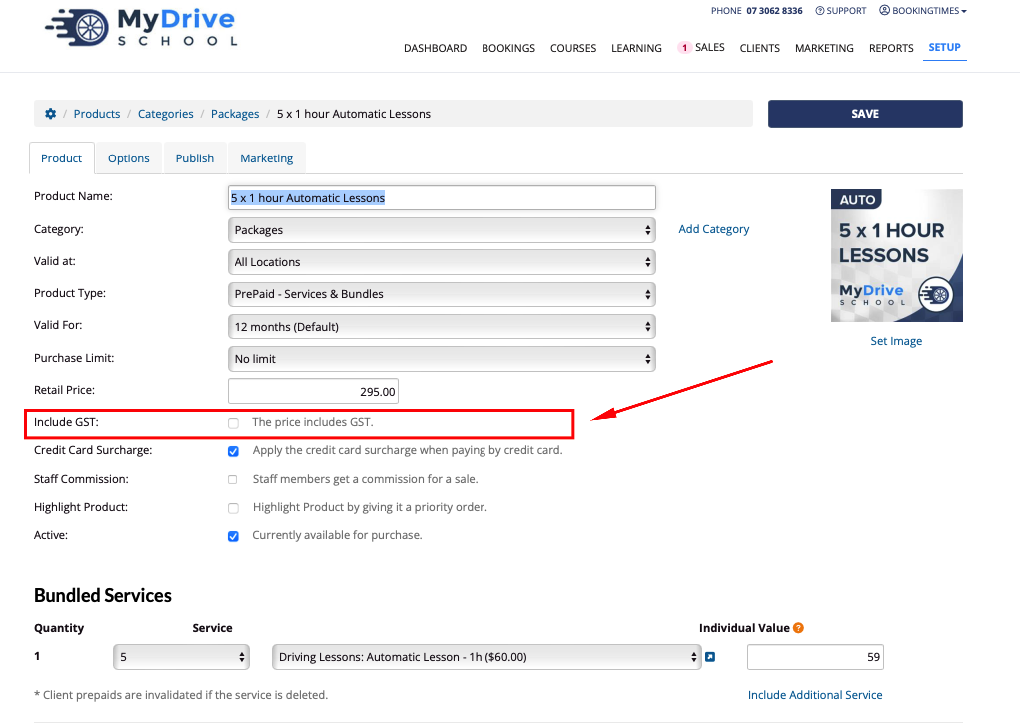

Navigate to Setup > Shopping > Products & Packages

Select the product

Check Include GST field

Click Save

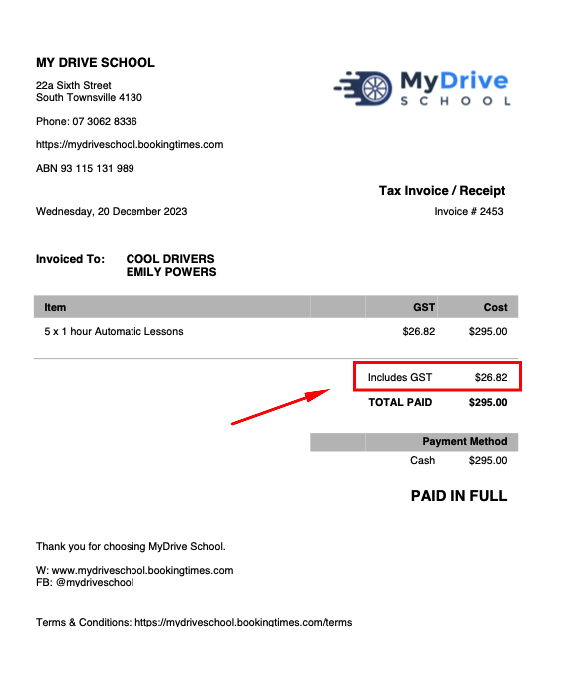

Sales tax on invoices

Once sales tax has been added to services or products, they will appear on any invoices accordingly.

Sales tax calculations on card processing fees

Sales Tax or GST accumulates on the card processing fee, but only for the invoice items which have sales tax applied.